In the field of financial analysis, evaluating a company’s stability and health is essential. Altman’s Z-Score, H Score, and Argenti’s A Score are three well-known models that are employed in this context. With the aid of these models, stakeholders can make well-informed judgements regarding a company’s financial situation. Each model provides distinct insights. Click here to learn Financial health & similar topic of SPOM-set B by Parag Gupta sir.

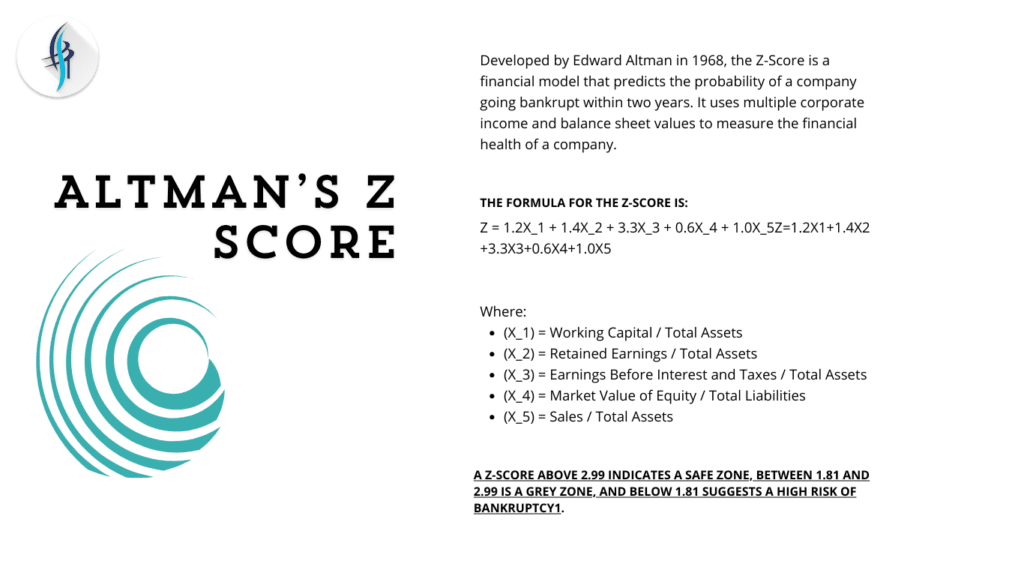

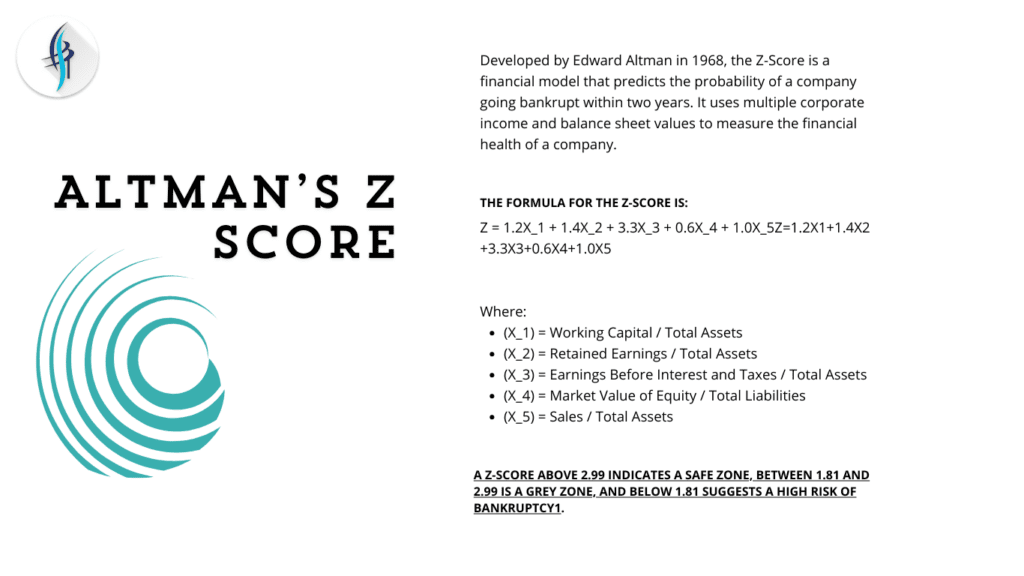

ALTMAN’S Z score

H Score

The formula is:

H = \frac{D_0 (1 + g_L) + D_0 H (g_S – g_L)}{r – g_L}H=r−gLD0(1+gL)+D0H(gS−gL)

Where:

- (D_0) = Dividend at time 0

- (g_L) = Long-term growth rate

- (g_S) = Short-term growth rate

- (H) = Half-life of the high-growth period

- (r) = Required rate of return

Argenti’s A Score

Argenti’s A Score is a diagnostic tool used to identify the risk of corporate failure. It was developed by John Argenti in the 1970s and focuses on three main areas: defects, mistakes, and symptoms. The A Score is calculated by assessing various factors within these areas, such as management quality, financial structure, and operational efficiency. The scoring system is:

- Defects: Fundamental issues like poor management or weak financial structure.

- Mistakes: Errors in decision-making or strategy.

- Symptoms: Indicators of potential failure, such as declining sales or increasing debt.

Each factor is scored, and the total score indicates the likelihood of corporate failure.

Conclusion

Altman’s Z-Score, H Score, and Argenti’s A Score are powerful tools for assessing the financial health of a company. While the Z-Score focuses on bankruptcy prediction, the H Score evaluates growth potential, and Argenti’s A Score diagnoses the risk of failure. Together, these models provide a comprehensive view of a company’s financial stability, aiding stakeholders in making well-informed decisions.

FAQ’s

It is used to identify the risk of corporate failure.

As per Argenti score 10 or less is satisfactory.

The H-Score is displayed on a scale of 0 to 100, with 0 being the weakest and 100 being the strongest.