In the field of financial analysis, evaluating a company’s stability and health is essential. Altman’s Z-Score, H Score, and Argenti’s A Score are three well-known models that are employed in this context. With the aid of these models, stakeholders can make well-informed judgements regarding a company’s financial situation. Each model provides distinct insights.

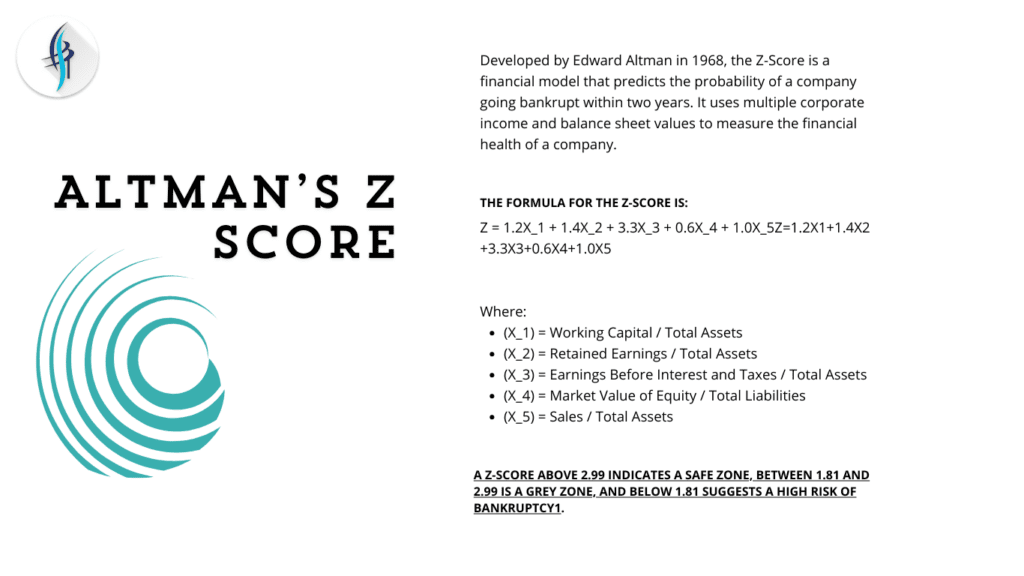

ALTMAN’S Z score

H Score

The formula is:

H = \frac{D_0 (1 + g_L) + D_0 H (g_S – g_L)}{r – g_L}H=r−gLD0(1+gL)+D0H(gS−gL)

Where:

- (D_0) = Dividend at time 0

- (g_L) = Long-term growth rate

- (g_S) = Short-term growth rate

- (H) = Half-life of the high-growth period

- (r) = Required rate of return

Argenti’s A Score

Argenti’s A Score is a diagnostic tool used to identify the risk of corporate failure. It was developed by John Argenti in the 1970s and focuses on three main areas: defects, mistakes, and symptoms. The A Score is calculated by assessing various factors within these areas, such as management quality, financial structure, and operational efficiency. The scoring system is:

- Defects: Fundamental issues like poor management or weak financial structure.

- Mistakes: Errors in decision-making or strategy.

- Symptoms: Indicators of potential failure, such as declining sales or increasing debt.

Each factor is scored, and the total score indicates the likelihood of corporate failure.

FAQ

It is used to identify the risk of corporate failure.

As per Argenti score 10 or less is satisfactory.

The H-Score is displayed on a scale of 0 to 100, with 0 being the weakest and 100 being the strongest.

Conclusion

Altman’s Z-Score, H Score, and Argenti’s A Score are powerful tools for assessing the financial health of a company. While the Z-Score focuses on bankruptcy prediction, the H Score evaluates growth potential, and Argenti’s A Score diagnoses the risk of failure. Together, these models provide a comprehensive view of a company’s financial stability, aiding stakeholders in making well-informed decisions.