In this article, you’ll learn about Indirect tax, the types of Indirect tax, and the advantages of Indirect tax.

Indirect Tax in India

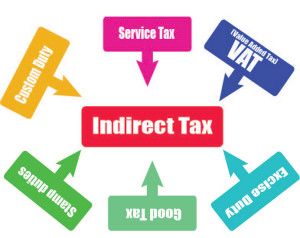

Indirect Tax: Charge levied by the State on consumption, expenditure, privilege, or right, but not on financial gain or property. Customs duties levied on imports, excise duties on production, excise tax, or value-added tax (VAT) at some stage in the production-distribution method, are samples of indirect taxes in India.

As a result, Indirect taxes are not levied directly on the financial gain of the patron or job holder. Since they are less obvious than taxation (because they do not show abreast of the wage slip) politicians are tempted to extend them to come up with additional state revenue, conjointly referred to as consumption taxes, their regressive measures as a result of not supporting the power to pay principle. Indirect totally differs from Direct tax.

Types of Indirect Taxes

Below are some types of Indirect Taxes :

- Service tax: This is the first and foremost type of Indirect Tax. Service tax is collected on services provided by the supplier. It’s just like excise duty wherever an associated quantity is collectible on a product that is factory-made. It’s a sort of revenue enhancement that’s collected by the govt when intense taxable services are provided by travel agents, restaurants, cable suppliers, cab services, etc. Service tax was proclaimed within the year 1994 as a vicinity of the Finance Act per section sixty-five

- Excise duty: This duty is applicable to all merchandise that area unit factory-made in the Asian nation. This tax is due to the makers and sometimes passed on to the purchasers. This tax in the Asian nation is levied by the Central Government and works in keeping with the provisions of the Central Excise Act, of 1944.

- VAT: Value Added Tax (VAT) is obligatory on the sale of movable merchandise within the nation. The VAT is levied {at all|in the least|the least bit|in the slightest degree|in associate degrees respect} stages of the assembly and channels that embrace an instance of import addition. This tax is levied by the State Governments underneath Entry fifty-four of the State List.

- Customs duty: It is one of those indirect taxes that area unit applicable for conveyance-foreign merchandise into the country. Insure instance, this duty may be levied on exported merchandise. The Customs Act, of 1962 provides lawson the levy and assortment of this duty, import and export procedures, penalties, prohibitions, and offense.

- Securities dealing Tax (STT): This tax is obligatory once stock area units are oversubscribed or purchased through any Indian stock market. STT was introduced in 2004 and is applicable to shares, mutual funds, and future and choices transactions. STT was obligatory to scale back the short capital gains tax and eliminate the long-run capital gains tax.

- Stamp duty: This is an associate degree tax charged by state governments on the transfer of stable property at intervals in their jurisdiction. additionally, tax is obligatory on all sorts of legal documents. Its rates vary from one state to a different.

- Entertainment tax: The state governments charge such tax on each dealing associated with amusement. Some examples area unit picture tickets, computer game arcades, stage shows, exhibitions, amusement parks, and sports-related activities

Advantages of Indirect Tax

Below mentioned are some advantages of Indirect tax

- Contribution by the poor: The poor folk square measure exempt from indirect taxes and this is often the sole manner of reaching this section of the society. This meets the fundamental principle of constructing all and sundry pay towards the expansion of the country through the state governments.

- Convenient: Taxpayers don’t seem to be burdened with indirect taxes as a result of these square measures paid solely whereas creating purchases. what is more, it’s convenient for the state authorities as a result the taxes square measure directly collected at the factories or the ports, which saves time still as effort.

- Easy assortment: The collection of these taxes is mechanically performed throughout the marketing and buying of products and services. This helps the authorities collect taxes simply whereas reducing the chance of nonpayment.

- Equitable: Indirect tax is directly associated with the costs of the products and services. Therefore, made folks buying luxury things pay higher taxes and the other way around.

Check Our Course – Check Now

- CA Final Costing (SCMPE)-Fasttrack Batch

- CA Final Costing SCM & PE(New Course)-Batch by Parag Gupta Sir